|

In a continuing effort to encourage technological innovation in the banking sector, FDIC’s technology lab FDiTech has released “Conducting Business with Banks: A Guide for Third Parties” a guide to help Fintech companies partner with banks.

In its press release the FDIC says that:

The FDIC Chairman Jelena McWilliams says "The FDIC will continue to work with banks and fintechs to help them understand how they can effectively work together to serve our nation's depositors." FDIC established FDiTech in 2019 to collaborate with community banks on how to deploy technology in delivery channels and back office operations to better serve customers. FDiTech is working to encourage innovation and partnerships at community banks through engagement, technical assistance, tech sprints, and pilot programs. Source: https://www.fdic.gov/news/news/press/2020/pr20017.html Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com

1 Comment

Stripe and Coinbase are regulated in Ireland to provide emoney services and Stripe, Coinbase, Robinhood, Plaid and Credit Karma are regulated in the United Kingdom.

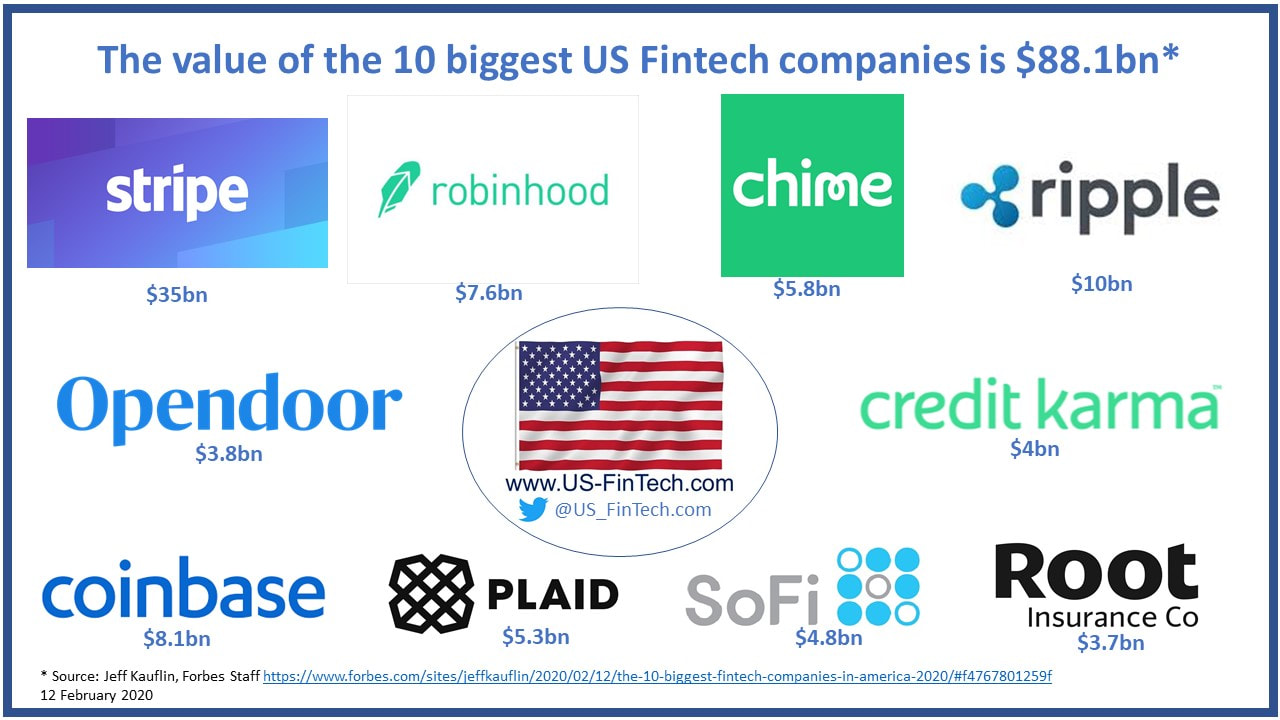

Who are "The 10 Biggest Fintech Companies In America 2020" according to Jeff Kauflin of Forbes? 1. Stripe - $35bn 2. Ripple - $10bn 3. Coinbase - $8.1bn 4. Robinhood - 7.6bn 5. Chime - 5.8bn 6. Plaid - $5.3bn 7. SoFi - $4.8bn 8. Credit Karma - $4bn 9. Opendoor - $3.8bn 10. Root Insurance - $3.7bn Source: https://www.forbes.com/sites/jeffkauflin/2020/02/12/the-10-biggest-fintech-companies-in-america-2020/#373c5fd81259. Consider following the author, Jeff Kauflin at https://twitter.com/JeffKauflin Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com The world’s biggest lender by market capitalisation is set to introduce savings and loans products using the Chase brand in the next few months, according to Sky News.

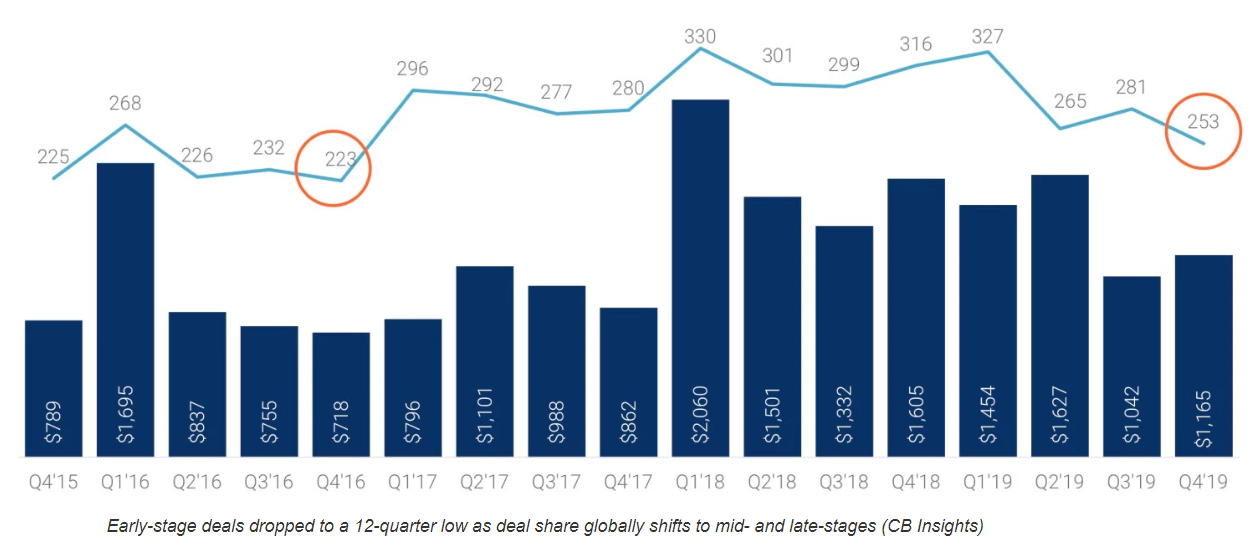

The New York-listed bank is due to hold an investor day next week and will set out growth strategy details. It is believed that the bank will launch a range of savings and loan products using the Chase brand in the UK in the next few months. This significant new entry into the UK consumer banking sector could spark a new price war among lenders already struggling to deal with a protracted period of ultra-low interest rates. Sources told Sky News that JPMorgan Chase has been in discussions with City and banking regulators about securing the necessary approvals to pave the way for the launch. It is understood the new service could launch as early as the second half 2020. The US-based bank reported in its fourth-quarter earnings last month that Chase had an average deposit base of $708bn (£540bn). Source: https://news.sky.com/story/jpmorgan-plots-launch-of-digital-consumer-bank-in-britain-11940211 Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com UPDATE 1 January 2024: Total fintech investment in the Americas reached an estimated $78.3bn with 2,136 deals in 2023. See updated post here Below is out post of 22 February 2020  Great article by CB Insights. Reports that financial services startups raised less money in 2019 than they did in 2018 as VC firms looked to back late stage firms and focused on developing markets, a new report has revealed. CB Insights’ annual report found that fintech startups across the world raised $33.9 billion in total last year across 1,912 deals, down from $40.8 billion they picked up by participating in 2,049 deals the year before.

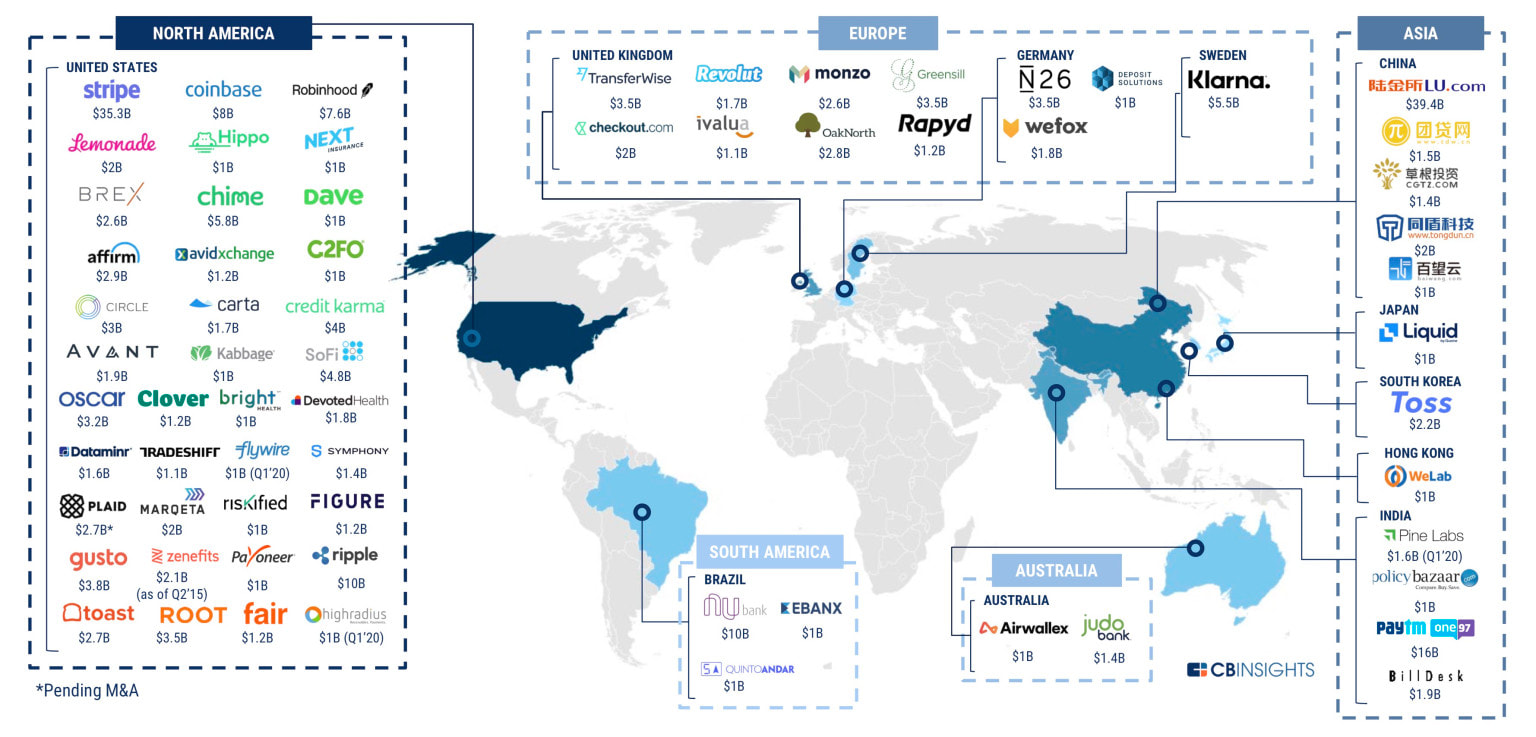

Image 1: In the North America box in the first image above, you will see those firms we wrote about in another post today on the Top Ten US Fintechs worth $88.1bn. Image 2: The bar chart above early-stage deals dropped to a 12-quarter low as deal share globally shifts to mid- and late-stages. The comprehensive report covers:

Source: https://www.cbinsights.com/research/report/venture-capital-q4-2019/ and https://techcrunch.com/2020/02/22/fintech-startups-raised-34b-in-2019/ Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com Varo Money, a mobile-only finance start-up, is a step closer to becoming a full-scale bank following the FDIC's approval of the fintech company’s national bank charter application.

This means Varo Money may now take customer deposits. Over the last number of years the US has seen many fintech and community bank partnerships where the likes of Varo, Chime, Robinhood and Square focus on customer interface apps leaving it to the banks that they partner with to hold customers’ money. Other examples of these types of partnerships include Apple and Goldman Sachs for the Apple Card and Google with Citi for a debit card. The deposits in the Varo arrangement are currently held by Bancorp. Those customer deposits will soon be transferred over to Varo subject to a few regulatory hurdles. Varo, valued at $417.8 million is backed by TPG and Warburg Pincus. It has someway to go to achieve the lofty valuations of newcomer US digital banks, such as Chime last valued at $5.8 billion. While non-US fintechs, such as Revolut and N26 are eyeing the US banking sector, none have progressed to an almost fully chartered bank status. Irish HQed fintech TransferMate partnered with Wells Fargo in 2019 to deliver "Global Invoice ConnectSM" which is used by US-based international businesses looking for more cost-effective solution for receiving payments from their global customers. TransferMate, while not a bank, is licensed across the US as a money service business, complementing its licensing and registration in Europe, Australia, Asia and the Middle-East. Other examples of fintech heading into banking territory include:

Source: https://www.cnbc.com/2020/02/11/start-up-bank-varo-gets-approval-to-become-a-full-scale-bank.html. Consider following the author Kate Rooney. https://www.independent.ie/business/irish/transfermate-seals-major-deal-with-us-giant-wells-fargo-38124846.html Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com |

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed