|

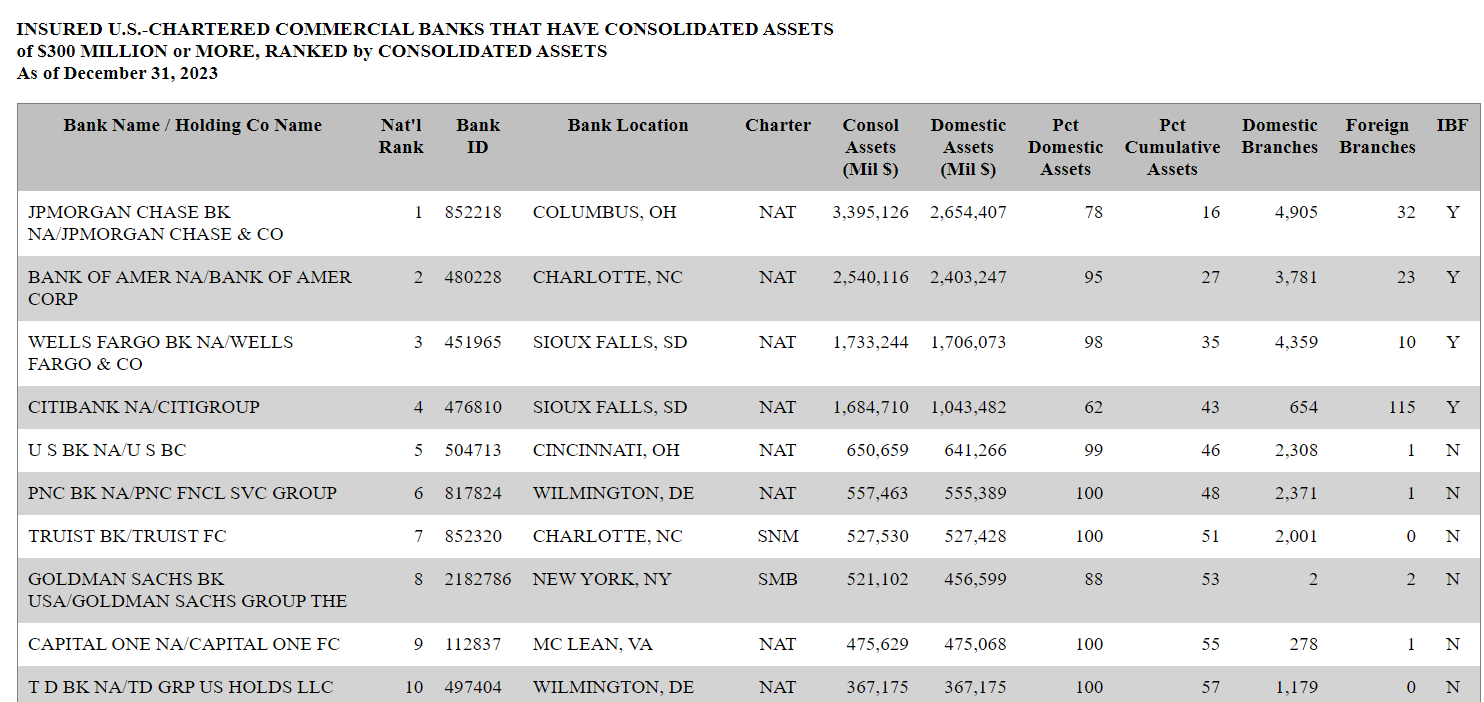

Last year we published the list of the top 10 US banks by consolidated assets at the end of 2022 / start of 2023. Find the blog here. It is interesting what a difference a year makes. While the top 10 is constituted by the same banks, TD Bank was dethroned from the Number 9 position by Capital One. The top 10 US Banks by consolidated assets at the end of 2023 / start of 2024 according to US Federal Reserve data are:

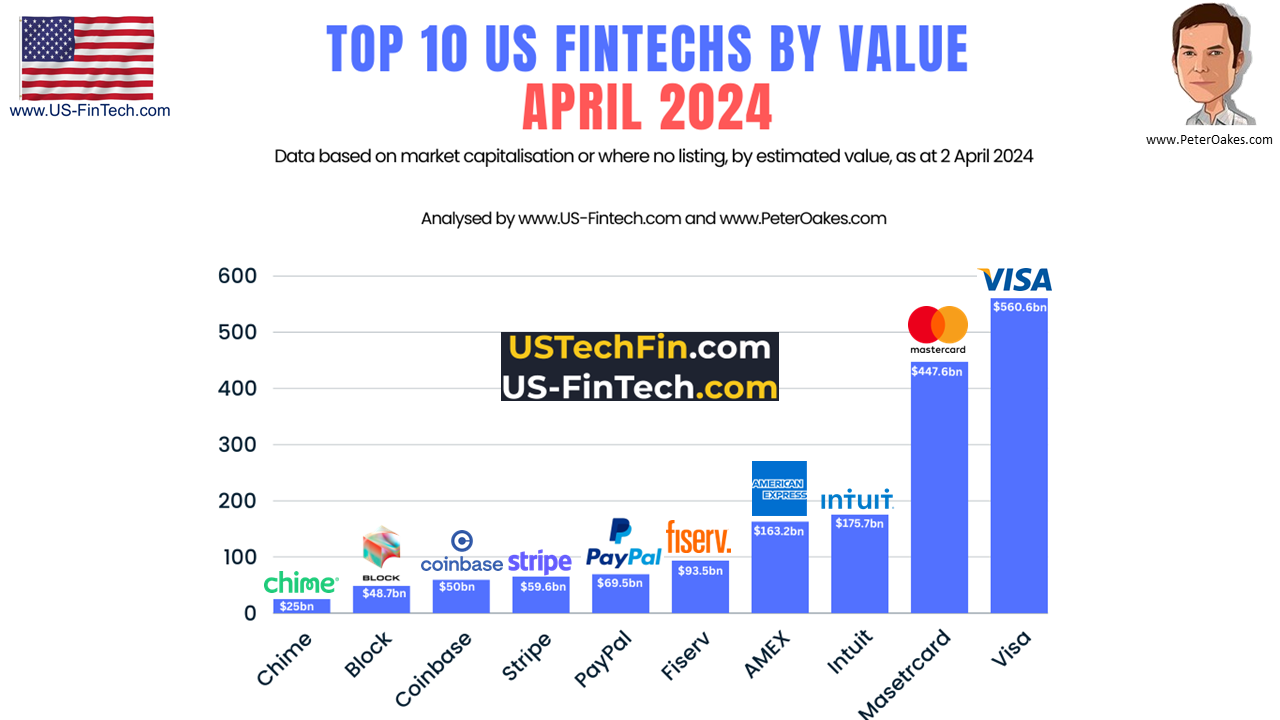

The top 10 #USfintech by market cap / estimated value (as of today - 02 April 2024) are:

One thought - With the top 5 US Banks being 4 times larger than the next 5 and those 2nd tier 5 banks having total assets 1.4 times greater than the market capitalisation / estimated value of the top 10 US fintech companies: "How can small(er) incumbent banks compete with both these existing giants and the continual onslaught of neobanks, challenger banks and non-banks offering banking services"? My tally of US banks is 2,140 banks (i.e. insured US-Chartered Commercial Banks with consolidated assets of $300mn or more). Source: (1) Peter Oakes and (2) https://www.federalreserve.gov/releases/lbr/current/default.htm

Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com

0 Comments

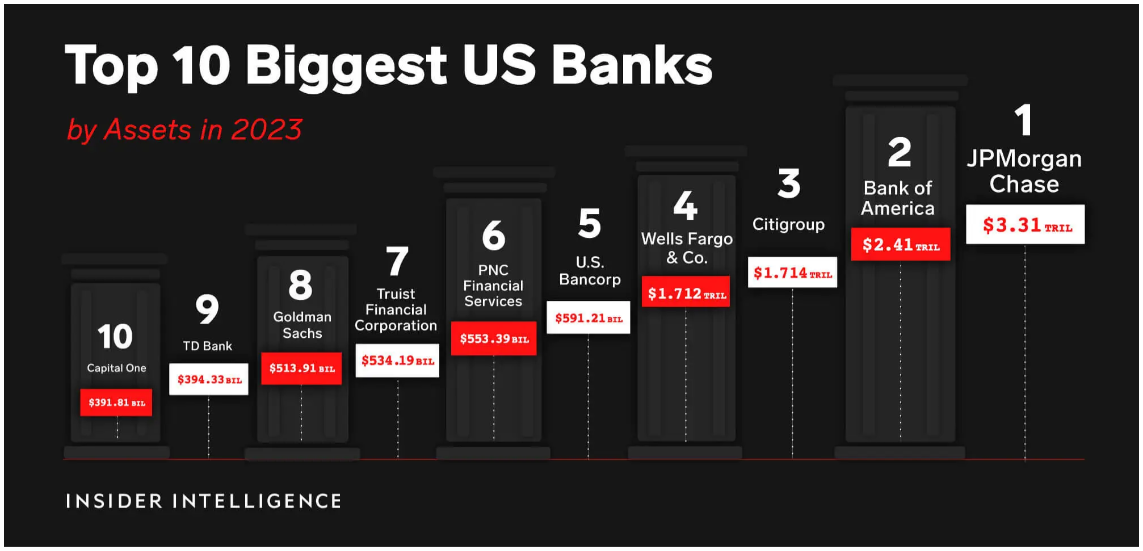

UPDATE: 01 April 2024. The list of the top 10 US banks can be found here. At the start of 2023, the top 5 US banks by balance sheet were: JPMorgan Chase ($3.21tn), Bank of America ($2.41tn), Citigroup ($1.714tn), Wells Fargo & Co ($1.712tn) and U.S. Bancorp ($591bn).

The Federal Reserve has rolled out a list of top US banks by assets as at 31 December 2022. For decades, banks have been merging, partnering, and expanding—so much so that the top four banks accounted for 50% of all US banking assets last year. In addition to having more than a trillion dollars in consolidated domestic assets, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo increased their tech spending to meet the growing demand for efficient mobile banking apps and compete with neobanks and other fintechs. The incumbents’ shift towards digital strategy gave them an edge among customers—from traditional to early adopters—regardless of their level of comfort with technology. This demonstrates that digital payment options are no longer complementary, but crucial in today’s mobile-first world. These are the top 10 banks in the US by assets, with key insights as to how they got there, where they plan to go in the future, and how smaller banks can stand out in a competitive industry. At the start of 2023, the 10 largest banks in the USA are:

Source: https://www.emarketer.com/insights/largest-banks-us-list/

Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com |

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed