|

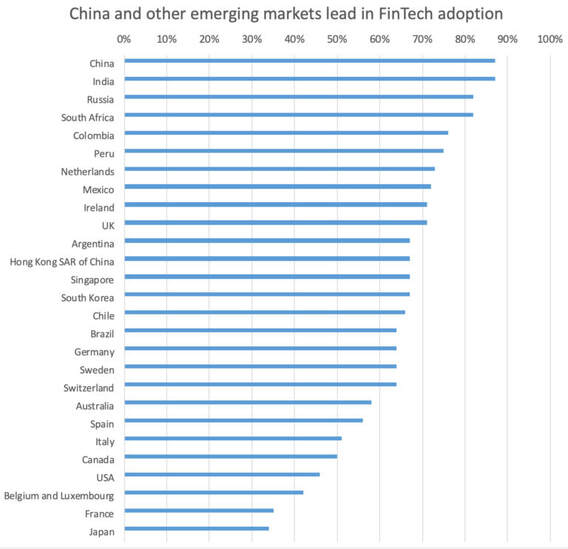

Kalin Anev Janse, secretary general and a member of the management board of the European Stability Mechanism has written an excellent article exploring whether Fintech can make the world more inclusive.

Kailin makes a number of interesting points:

Encourage you to read the full article at the link below. Source: https://knowledge.wharton.upenn.edu/article/can-fintech-make-the-world-more-inclusive/. Consider following the author on twitter @whartonknows Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com

0 Comments

|

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed