|

Check out this upcoming webinar featuring US TechFin Intersystems, co-hosting with Fintech Ireland on the topic of Big Data!

Fintech Future: Banking on Big Data “a 'data driven' approach is emerging across the financial sector affecting institutions business strategies, risk and operations with respective changes in the mind-set and culture still in progress” What: Fintech Future: Banking on Big Data (Fintech Ireland & Intersystems) When: Tuesday 19th January 2021 at 1400 Irish/UK time (0900 US Eastern Standard Time) Where: Online Event Cost: Free Registration: https://intersystems.com/uk/fintechirelandwebinar (or via https://fintechireland.com/events/the-future-of-fintech-banking-bigdata) Description: Fantastic response to and signups for the Fintech Ireland and InterSystems UKI upcoming co-hosted webinar on "The Future of Fintech: Banking on Big Data" with an expert panel of regulator and industry data experts who will discuss the growing importance of this area for TechFin, Fintech & FinServ. A 'data driven' approach is emerging across the financial sector affecting institutions business strategies, risk and operations with respective changes in the mind-set and culture still in progress. Speakers:

Thanks to Simon Cocking & the team at Irish Tech News for covering & publishing articles on the impact of big data & advanced analytics: * Leveraging Innovative Technology To Ensure Success For Ireland’s Fintech Sector - https://irishtechnews.ie/leveraging-innovative-technology-ireland-fintech/ * Fintech Future: Banking On Big Data - https://irishtechnews.ie/fintech-future-banking-on-big-data-webinar/ This blog is curated based on material published by FT Partners.

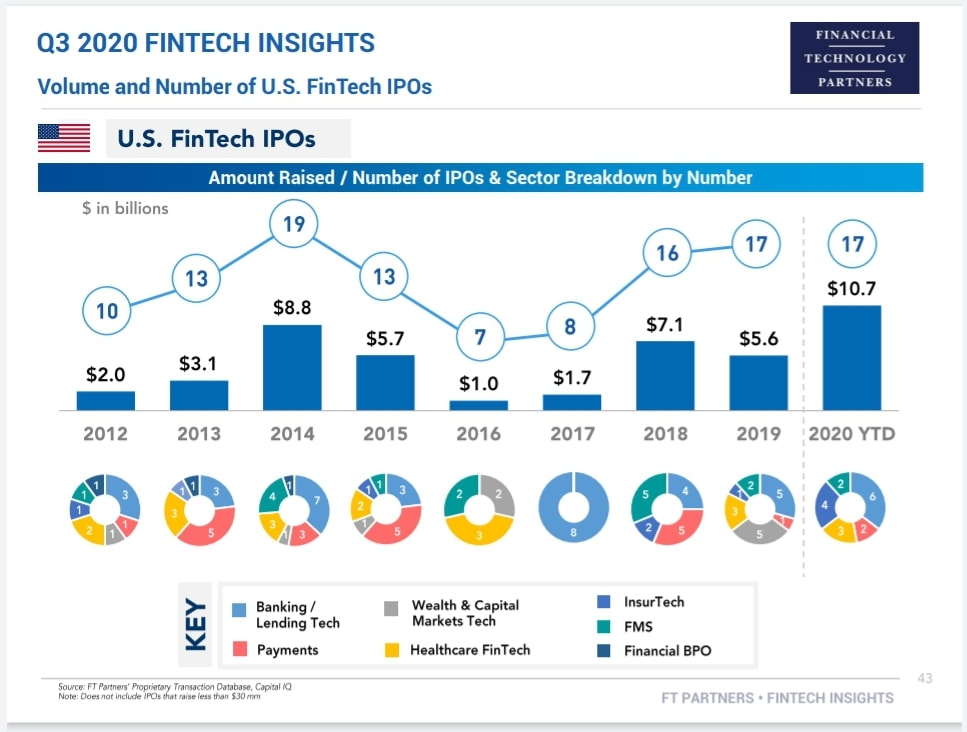

FT Partners Publishes Q3 2020 FinTech Insights The top 10 take-aways about Fintech in Q3 2020, according to FT Partners:

Read More: Note: FT Partners’ FinTech Insights Reports are published on a quarterly basis, along with a comprehensive year-end FinTech Almanac. All information included in the reports is sourced from FT Partners’ Proprietary Transaction Database, which is compiled by the FT Partners Research Team through primary research and data analysis. We could not agree more, David! This article in Forbes neatly positions the TechFin v FinTech debate (if there is one at all) and why we are delighted to have USTechFin.com to complement US-Fintech.com. "it is the TechFins, not the FinTechs, who are the real challengers. "The TechFins, not the FinTechs, who are the real challengers." says David G.W. Birch, Contributor Fintech, Forbes.com who is a Fintech Author, advisor and global commentator on digital financial services. Other points to note:

Further reading: The Economist (“Plug and pay”, 21st November 2019) |

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed