|

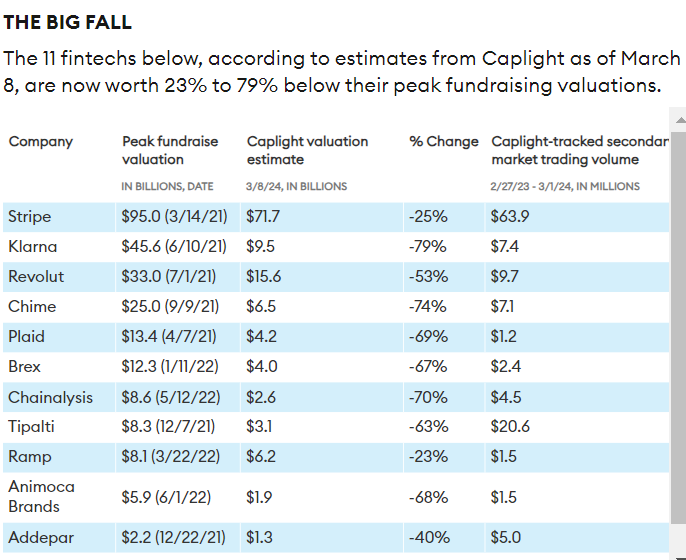

The current estimated value of 11 leading private fintech startups shows declines as high as 79%. But a few have started to recover. Back in November 2021, as the market for venture capital funding of fintech companies was peaking, San Francisco Bay Area bill-payment startup Tipalti raised $270 million at an $8.3 billion valuation. Then last summer, shares in the company traded hands privately at a $4 billion value. Today, by one estimate, Tipalti is worth just $3.1 billion, down 63% from its peak, even though it has been growing smartly—to 3,500 mostly U.S.-based business customers now, up from 2,000 at the end of 2021. Chen Amit, Tipalti’s 58-year-old Israeli cofounder and CEO, considers $3 billion way too low, but he acknowledges that the inflated valuations of 2021 are history. “We just need to accept it. There's no need to fight it,” Amit says, pointing to other private fintech companies, such as Stripe and Klarna, that have raised money since then in down rounds. He adds: “I will not sell my shares at $3 billion. I doubt any knowledgeable person would.” The extraordinary boom and bust in venture capital funding for the fintech industry has left a puzzle in its wake: what are these startups really worth today? With VC dollars flowing to the industry plunging from $141 billion in 2021 to $39 billion globally in 2023, according to CB Insights, many startups have scrambled to conserve cash to avoid raising funds at a dramatically reduced valuation. Meanwhile, those further along the growth path have delayed initial public offerings as already-public fintechs are languishing, off about 50% from their peak, despite the S&P 500 and the tech-heavy Nasdaq recently setting new highs. All that has left a void of information—one now being filled by new platforms like Caplight and Notice that generate valuation estimates based on the secondary-market trades they track through their partnerships with brokers. These estimates may also incorporate public disclosures of markdowns taken by mutual funds holding shares in private companies, the prices of comparable publicly traded stocks and other data. Soon after Tipalti’s 2021 fundraise, stocks started tanking and the Federal Reserve began raising interest rates. Amit made aggressive moves to prepare the company for leaner times, laying off 11% of employees. “We knew we had fat in the organization,” he says. While the company maintains sizable staff in Israel, San Francisco and Vancouver, when it started hiring again, it emphasized lower-cost locations like Tbilisi, Georgia. And Tipalti continued to grow–it now processes about $5 billion in monthly payments, up from $3 billion at the time of its 2021 fundraise. (The company says it retains 99% of its customers each year.) So what’s Tipalti worth now? In the summer of 2023, a Tipalti shareholder sold about $20 million worth of stock on the secondary market at a $4 billion valuation, according to Oren Zeev, a venture capitalist and Tipalti cofounder. In the fourth quarter of 2023, Capital Group, one of the largest mutual fund companies in the world, marked its shares at $3.7 billion. Now Caplight, a San Francisco startup that both tracks secondary-market trades of private tech companies and provides a venue to trade shares, estimates Tipalti’s value at just $3.1 billion–a number that also takes account of the stock slump of several of Tipalti’s competitors including publicly traded Bill, which is off 80% since its late 2021 peak. Caplight shared with Forbes its valuations for a long list of fintechs it tracks. The chart below shows its estimates, as of March 8, for 11 of them–all sizable startups where private trades and other information available within the past year provide a foundation for those valuations. Of course, these are still just estimates. As befits a burst bubble, some of the declines in value from their fundraising peak valuation are dramatic–an estimated 79% for Klarna and 74% for Chime. Many of the companies, which were all given a chance by Forbes to comment on these values, pushed back, and you can see their responses in the company write-ups at the bottom of this story.

0 Comments

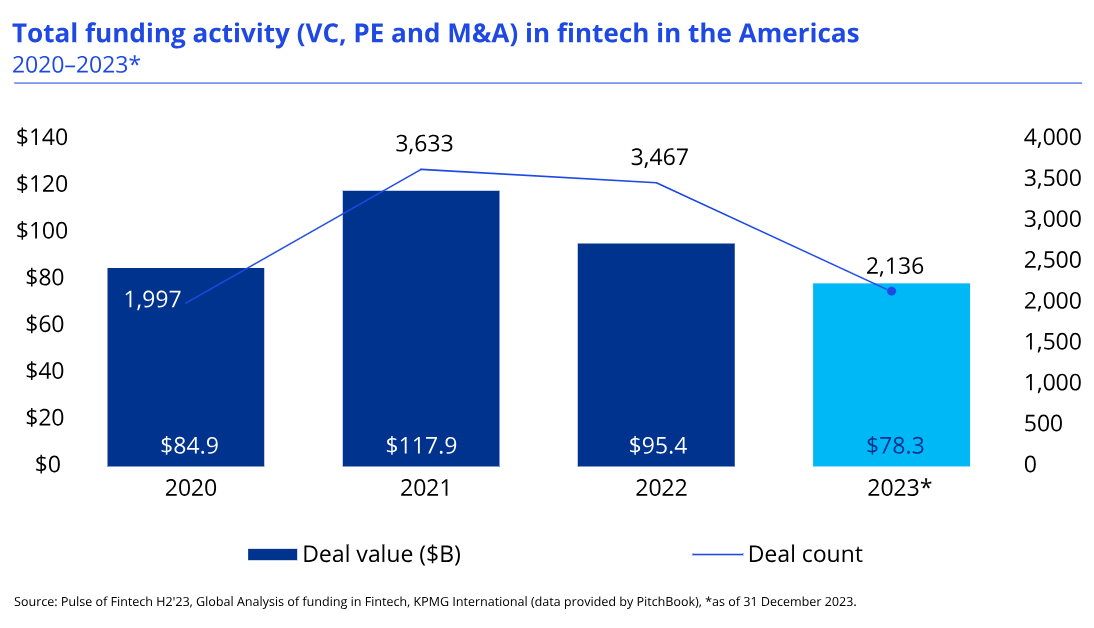

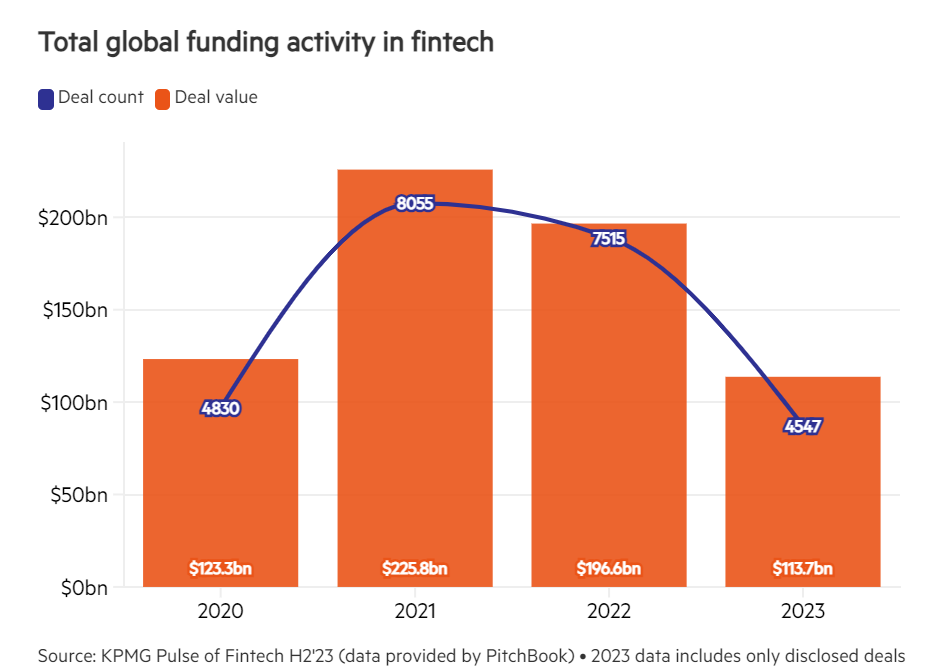

Total fintech investment in the Americas reached an estimated $78.3bn with 2,136 deals in 2023. Total fintech investment in the Americas dropped from $95.4 billion in 2022 to $78.3 billion in 2023 as the number of fintech deals plummeted from 3,467 to 2,136. The US attracted the vast majority of fintech deals activity during the year, accounting for $73.5 billion of investment across 1,734 deals. The second half of 2023 was particularly soft for fintech deals activity in the Americas as investors enhanced their scrutiny of potential deals even further. During H2’23, the Americas attracted $38.4 billion of investment across 916 deals, of which the US accounted for $34.8 billion across 627 deals. The three largest deals in H2’23 occurred in the US, including the $11.7 billion acquisition of real estate data analytics company Black Knight by Intercontinental Exchange, the $10.5 billion acquisition of regtech and risk management software firm Adenza by Nasdaq, and the $1.2 billion buyout of wealth management firm Avantax by Cetera. Global investment in fintech nosedived in 2023, plunging to a five-year low of $113.7bn from 4547 deals Global investment in fintech nosedived in 2023, plunging to a five-year low of $113.7bn from 4547 deals. This marked a 42 per cent decline from the $196.3bn reported in 2022 and represented the weakest result since 2017. Source: (1) https://kpmg.com/xx/en/home/insights/2024/02/pulse-of-fintech-h2-2023-americas.html and (2) https://www.thebanker.com/Global-fintech-investment-collapses-in-2023-1707725810

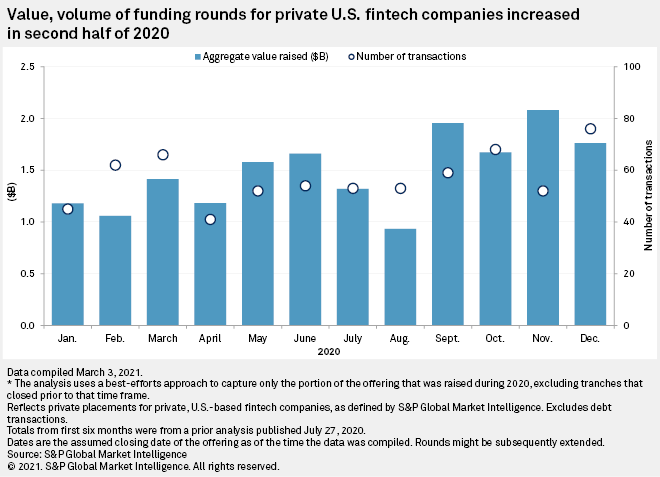

Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com S&P Global Market IntelligenceU.S. fintech funding in 2020 outpaced 2019 in both amount raised and volume of transactions, despite — and in some ways due to — the COVID-19 pandemic. S&P Global Market Intelligence foresees another strong year in 2021, which has already burst out of the gates due to Robinhood Markets Inc.'s $3.4 billion raise amid the GameStop Corp. frenzy.

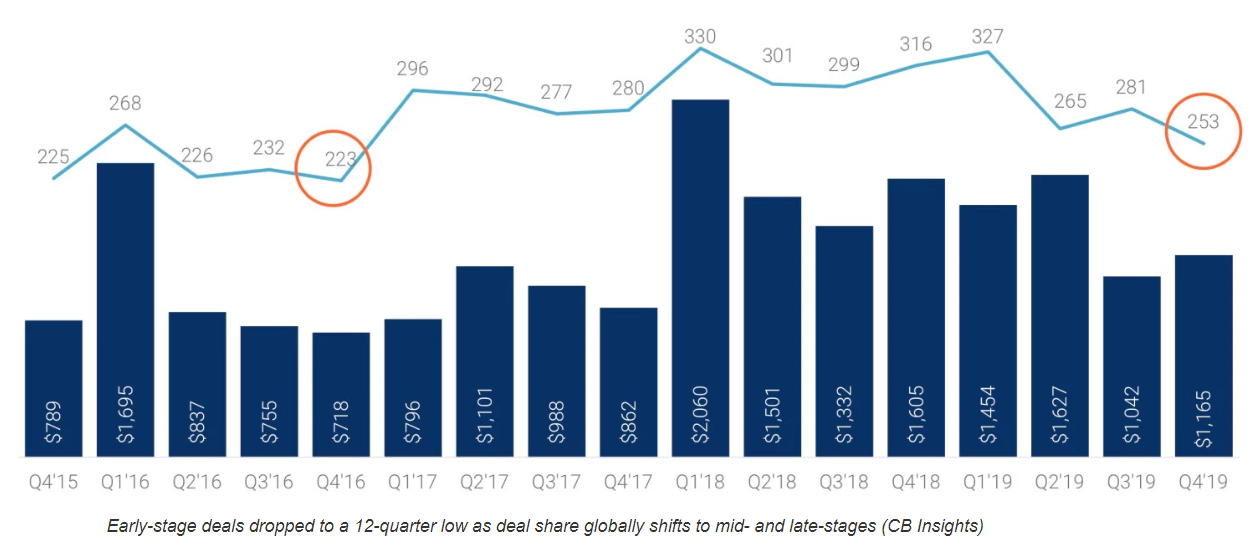

Though the virus wreaked economic havoc in 2020, interest rates remained relatively low, consumers embraced digital channels and the routes for venture capital firms to exit their investments, be it public offerings or M&A, remained open. Each of these factors likely contributed to the $17.8 billion that investors poured into private U.S. fintech companies in 2020, via 681 transactions, up from $14.8 billion and 539 transactions in 2019. While the fundraising situation appeared somewhat precarious in April 2020, with the volume of transactions falling about 38%, activity rebounded in subsequent months. Source: S&P Global Market Intelligence: https://www.spglobal.com/marketintelligence/en/news-insights/research/us-fintech-funding-still-going-strong-following-20-jump-in-2020 UPDATE 1 January 2024: Total fintech investment in the Americas reached an estimated $78.3bn with 2,136 deals in 2023. See updated post here Below is out post of 22 February 2020  Great article by CB Insights. Reports that financial services startups raised less money in 2019 than they did in 2018 as VC firms looked to back late stage firms and focused on developing markets, a new report has revealed. CB Insights’ annual report found that fintech startups across the world raised $33.9 billion in total last year across 1,912 deals, down from $40.8 billion they picked up by participating in 2,049 deals the year before.

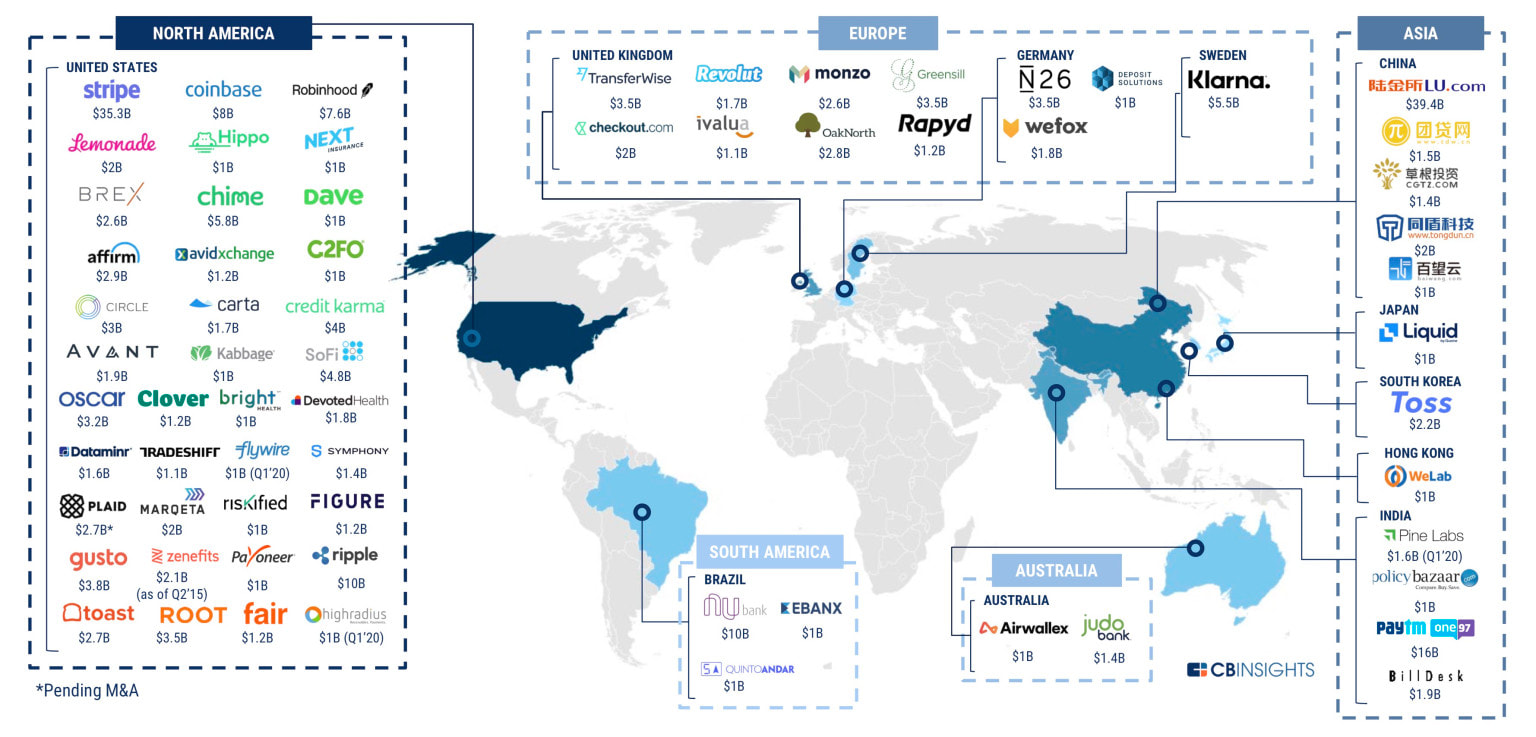

Image 1: In the North America box in the first image above, you will see those firms we wrote about in another post today on the Top Ten US Fintechs worth $88.1bn. Image 2: The bar chart above early-stage deals dropped to a 12-quarter low as deal share globally shifts to mid- and late-stages. The comprehensive report covers:

Source: https://www.cbinsights.com/research/report/venture-capital-q4-2019/ and https://techcrunch.com/2020/02/22/fintech-startups-raised-34b-in-2019/ Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com |

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed