|

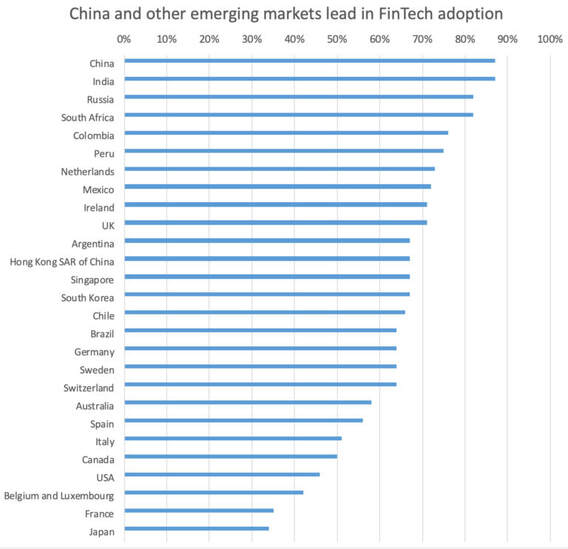

Kalin Anev Janse, secretary general and a member of the management board of the European Stability Mechanism has written an excellent article exploring whether Fintech can make the world more inclusive.

Kailin makes a number of interesting points:

Encourage you to read the full article at the link below. Source: https://knowledge.wharton.upenn.edu/article/can-fintech-make-the-world-more-inclusive/. Consider following the author on twitter @whartonknows Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com

0 Comments

The United States biggest banks have grown substantially. The top 15 largest banks now hold a combined total of $13.7 trillion in assets. And the top 10 banks' share is approaching 80% of that figure, at $10 trillion. Not only does size matter, the concentration of assets held increases exponentially as you move up the food chain.

On our home page, we noted that, the value of the top 10 US FinTech companies was $88.1bn. With the top 5 US Banks being 4 times larger than the next 5 and those 2nd tier banks being almost 3 times the size of the top 10 Fintechs, this poses an interesting question. "How can small incumbent bank compete with both these existing giants and the continual onslaught of neobanks, challenger banks and non-banks offering banking services"? Source: https://www.bankrate.com/banking/biggest-banks-in-america/. Consider following the author, Amanda Dixon, on twitter at https://twitter.com/amandaadixon Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com |

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed