|

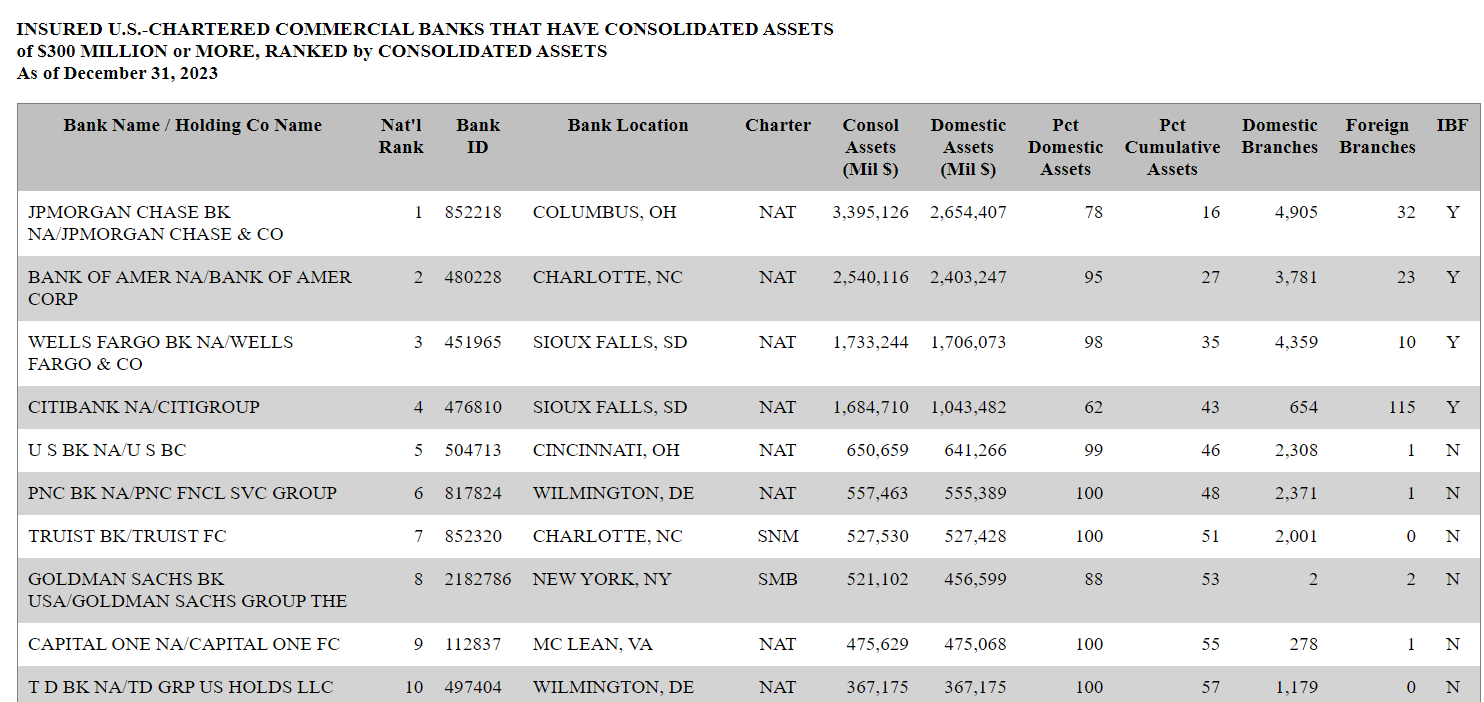

Last year we published the list of the top 10 US banks by consolidated assets at the end of 2022 / start of 2023. Find the blog here. It is interesting what a difference a year makes. While the top 10 is constituted by the same banks, TD Bank was dethroned from the Number 9 position by Capital One. The top 10 US Banks by consolidated assets at the end of 2023 / start of 2024 according to US Federal Reserve data are:

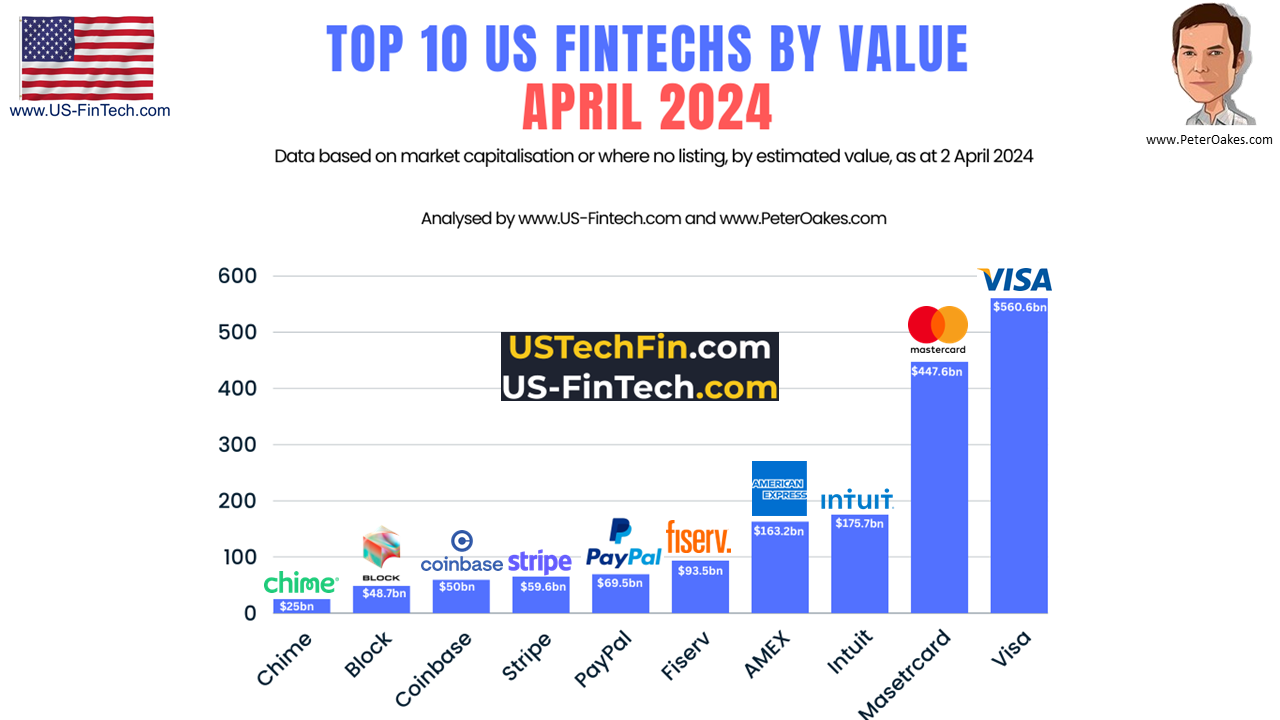

The top 10 #USfintech by market cap / estimated value (as of today - 02 April 2024) are:

One thought - With the top 5 US Banks being 4 times larger than the next 5 and those 2nd tier 5 banks having total assets 1.4 times greater than the market capitalisation / estimated value of the top 10 US fintech companies: "How can small(er) incumbent banks compete with both these existing giants and the continual onslaught of neobanks, challenger banks and non-banks offering banking services"? My tally of US banks is 2,140 banks (i.e. insured US-Chartered Commercial Banks with consolidated assets of $300mn or more). Source: (1) Peter Oakes and (2) https://www.federalreserve.gov/releases/lbr/current/default.htm

Posted by Peter Oakes (www.peteroakes.com / Twitter @oakeslaw @US_Fintech @FintechUK_HQ @FintechIreland) #FintechUS #USFintech See also www.UKFintech.com www.FintechIreland.com

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed