|

S&P Global Market IntelligenceU.S. fintech funding in 2020 outpaced 2019 in both amount raised and volume of transactions, despite — and in some ways due to — the COVID-19 pandemic. S&P Global Market Intelligence foresees another strong year in 2021, which has already burst out of the gates due to Robinhood Markets Inc.'s $3.4 billion raise amid the GameStop Corp. frenzy.

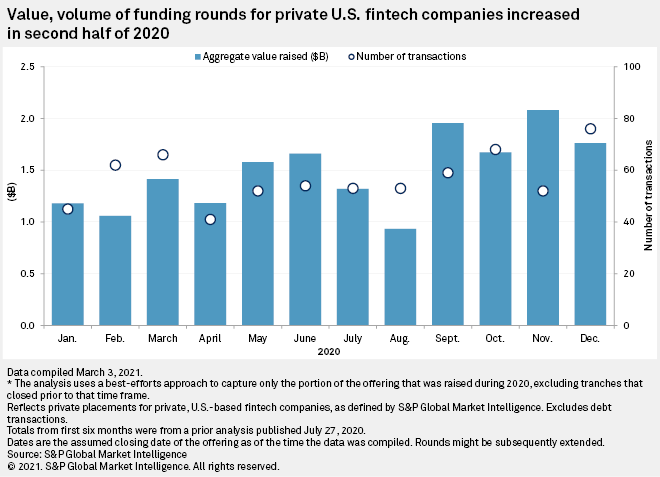

Though the virus wreaked economic havoc in 2020, interest rates remained relatively low, consumers embraced digital channels and the routes for venture capital firms to exit their investments, be it public offerings or M&A, remained open. Each of these factors likely contributed to the $17.8 billion that investors poured into private U.S. fintech companies in 2020, via 681 transactions, up from $14.8 billion and 539 transactions in 2019. While the fundraising situation appeared somewhat precarious in April 2020, with the volume of transactions falling about 38%, activity rebounded in subsequent months. Source: S&P Global Market Intelligence: https://www.spglobal.com/marketintelligence/en/news-insights/research/us-fintech-funding-still-going-strong-following-20-jump-in-2020

0 Comments

Leave a Reply. |

AuthorPeter Oakes is the primary author and curator of this page. We welcome others, and you will be fully and fairly credited in your contribution. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed